The New 'Not' Normal - How are We Going to Pay for This Debt?

NEWS PROVIDED BY

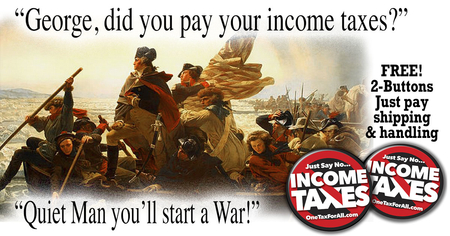

One Tax For All

May 19, 2020

FREDERICKSBURG, Va., May 19, 2020 /Standard Newswire/ -- The new "not" normal has left us in massive debt, and the US INCOME TAX SYSTEM will never be able to pay for this?

It's time for a new way to collect taxes that is good for America! ONE TAX FOR ALL – NATIONAL SALES AND TRANSACTION TAX SYSTEM; This is not a VAT TAX! Just one tax system for all tax collections.

The income taxes have never worked and failed to collect enough revenue for the U.S. annual federal budget creating unsustainable debt. Now with the coronavirus stimulus funding, USG has doubled the annual budget with no way to collect enough taxes.

One Tax For All – the only truly "One-Page" tax system is simple, easy, low rates, and spread across all segments of our economy. The gov't will not be able to pick "WINNERS AND LOSERS" with the "One Tax For All" plan. Founder of OneTaxForAll.com, Stephen Redden says everyone will have a "Little Skin in the Game."

One Tax For All is a national sales and transaction tax that eliminates the maze of out of date taxes – federal and state. With trillions of dollars of sales and transactions each year in the US rates will never be over 5% and could be even as low .5%.

Redden after living in Florida for years paying no state income-tax wondered why a national sales and transaction tax would not work for the whole United States. Redden says "People are moving to states like Florida and Texas just because there is no state income tax, buy a candy bar and coke you have paid your taxes, it's great!"

The website www.OneTaxForAll.com explains in great detail how and why this tax system works. Plus, there is a download pdf that speaks to life, liberty, and financial freedom.

Contact Stephen Redden for more information: 727-776-3316 or email GetInvolved@OneTaxForAll.com.

MORE INFORMATION:

This system is a cash system, pay as you go for everyone, every business, and enterprise. The greatest benefit of this tax system is citizens/taxpayers get to keep most of the wealth they create for themselves.

Consumer sales taxes work in Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming additionally New Hampshire and Tennessee don't tax wages. Over 20% of the US population pays no state income taxes.

This is proof that a sales tax system works even while limited to just consumer items. The dynamic of a sales and transaction tax is every segment of the economy is taxed very low and evenly. This eliminates taxes that pick winners and losers for political or social gain.

SOURCE One Tax For All

CONTACT: Stephen Redden, 727-776-3316, GetInvolved@OneTaxForAll.com

Related Links

www.OneTaxForAll.com

Sign Up to Receive Press Releases:

Sign Up to Receive Press Releases: